In contrast to its large peers, government-owned Steel Authority of India (SAIL) has been a laggard, both in financial performance and on the bourses (see charts). A key reason is that despite access to captive raw material sources for a large part of its requirement, its operating profit (profit before interest, depreciation, and tax) margin has been far lower than peers Tata Steel’s domestic operations and JSW Steel.

Second, its capacity expansion plans have been delayed time and again. This not only dampened sentiment but also impacted its financials — high debt and low return ratios. While some of this is expected to change, the benefits are likely to take a longer time.

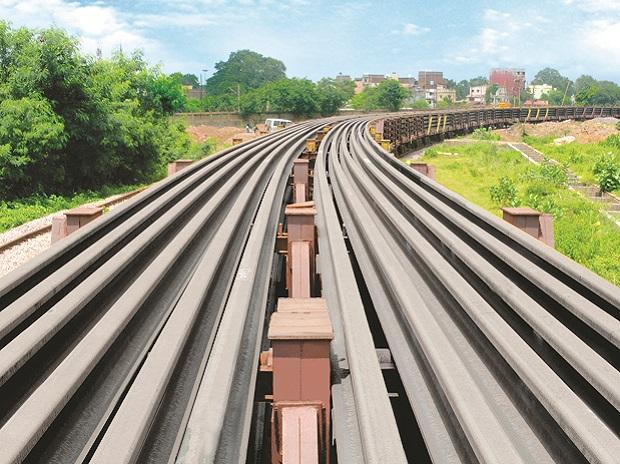

The chairman of SAIL, at the recent annual general meeting of shareholders, said the company was in the final leg of its modernisation and expansion programme. The new universal rail mill at Bhilai (Chhattisgarh) was commissioned in January. The new blast furnace at Rourkela Steel Plant (RSP, Odisha) achieved 100 per cent capacity utilisation. SAIL’s new three million tonnes per annum (mtpa) hot strip mill at RSP is scheduled to be installed by 2018 and will enlarge the basket of value-added products.

With expansions getting over, SAIL’s saleable steel capacities will reach more than 20 mtpa and crude steel to 21.4 mtpa by 2018, helping it regain the status of the country’s largest steelmaker.

Investors will be hoping these already delayed expansions would now finally get over. The continuous delay in these had meant that the benefits were postponed; also, project costs continued to escalate, leading to higher debt (see chart). Analysts now expect debt to rise to Rs 53,666 crore by the end of FY18. Concern at rising debt is reflected in the view of analysts at Motilal Oswal Securities. “Net debt will continue to rise, eroding equity value,” they say and so maintain their bearish stance on SAIL.

Rising debt also meant interest costs continued rising, leading to a loss at the net level. Until FY15, SAIL generated enough operating profit to service debt and post net profit. Since then, operating profit has not been enough to meet interest and depreciation costs. This is also in sharp contrast to the performance of Tata Steel (India operations) and JSW Steel.

And, even the recent performance is far from impressive and comes when the macro environment for the domestic industry has improved. For instance, realisations have seen improvement after implementation of a Minimum Import Price (MIP) on steel import in February 2016, besides other measures by the government. This helped the industry rebound from its decade-low utilisation level of FY16. SAIL, benefited like the others, with its per-tonne Ebitda (profitability, excluding other income) improving in April-September of FY17 but rising coal costs and employee expenses have weighed on operating profits since the December ’16 quarter.

Though JSW Steel and Tata Steel also saw cost pressure, they have been reporting improving profitability. These companies, too, have completed capacity enhancements and are expanding further. Not surprising, the two are preferred picks of analysts.

SAIL says it is in the process of improving profitability by shifting production through energy-efficient processes. It plans to increase market share through additional volumes and new products, improve its mix in favour of value-added products and focus on finished steel. Efforts are on to reduce employee cost through a voluntary retirement scheme. So, there is hope of a turnaround.

Meanwhile, the recent surge in steel prices amid improving demand and supply measures in China should help in improving the profitability of domestic players, including SAIL.

Analysts expect SAIL to achieve 15 million tonne sales and report profit at the operating level in FY18 with the profit doubling in FY19. However, operating profit might still not be enough to meet interest and depreciation costs, and SAIL would continue to report loss at the net level till FY19, estimates Motilal Oswal Securities.

Analysts at Edelweiss Securities say despite the likelihood of SAIL turning profitable in the ensuing quarters, the relative performance is expected to remain subdued, owing to progressive ramp-up (of capacities), higher conversion cost and leverage playing spoilsport. The benefits of modernisation projects would be visible only after FY20.

Get more details here:-

0 comments:

Post a Comment