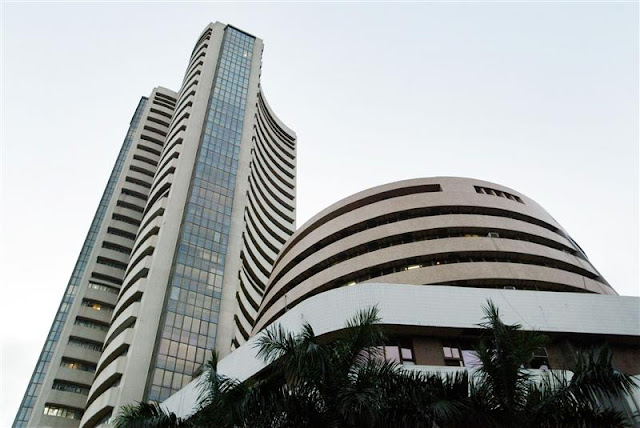

The stock market continued to charge ahead on Friday with the BSE’s benchmark Sensex scaling the 31,000-mark for the first time and the National Stock Exchange’s Nifty testing 9,600. Both rallied close to a per cent each, led by strong gains in heavyweights such as ITC and Reliance Industries, which rose three per cent and 2.5 per cent, respectively.

The Sensex closed at 31,028.21, the latest 1,000-point rally coming in only 21 trading sessions. The 31,000-mark was breached the day the Narendra Modi government completed three years in office.

Experts said investors were betting on a sustained pick-up in the economy and corporate earnings, led by reforms such as the goods and services tax and tackling of bad loans. According to Nirmal Jain, chairman, IIFL, this push, coupled with a positive earnings visibility and strong institutional flows, were key factors behind the rally.

Although global cues were mixed on Friday, sentiment was spurred by the US Federal Reserve’s minutes, which suggested optimism over the world’s largest economy and signalled a gradual hike in rates.

The BSE mid-cap and small-cap indices, under pressure in the past few sessions, rebounded two per cent and 1.6 per cent, respectively. The broader market breadth was positive, about two stocks advancing for each declining one. The Sensex and Nifty posted their third straight weekly gains.

Domestic institutional investors (DIIs) were strong buyers on Friday, pumping in over Rs 1,000 crore, showed the data. Foreign investors, on the other hand, were seen taking money off the table, following the sharp gains in recent weeks.

“In the first two years of office, there was scepticism in the markets about the government. However, people are now confident about the leadership and the economy’s direction. Domestic institutions, led by mutual funds, have emerged as a strong counterweight to foreign flows,” Jain added.

Market participants said the rally was sustainable, as there were no near-term risks visible. However, they didn’t rule out a correction in certain pockets, particularly in companies with weak fundamentals.

The earnings for the quarter ending June would play a key role in deciding the market direction. Many stocks have ballooned in the last two months on expectation of strong earnings recovery. Although the March quarter results beat analyst expectations, the performance was largely on account of a lower base.

“Since the beginning of 2017, Indian markets have gone up significantly. However, this rally has not been amply supported by earnings recovery.

While blue-chip companies will continue to be in demand, due to strong institutional buying, we might see some corrections in smaller companies where the valuations have skyrocketed,” said G Chokkalingam of Equinomics Research & Advisory. Since the demonetisation lows, the benchmark indices

have risen over 20 per cent. Shares of seven Sensex companies — HDFC Bank, ITC,Maruti Suzuki India, Tata Steel, Adani Ports, Larsen & Toubro and Asian Paints — saw their shares rally over 30 per cent since the December 26 bottom.

Pharmaceutical and infromation technology (IT) stocks have been laggards in this year’s rally. Introduction of any new protectionist policies by the US government could be a major threat for Indian markets, especially on such stocks.

A top foreign broker said although India had been an outperformer in the emerging markets space in the past three years, the trend was not expected to continue in the near-to-medium term, as the IT and pharma stocks could be an overhang.

Get more details here:-

* Investment & trading in securities market is always subjected to market risks, past performance is not a guarantee of future performance.

0 comments:

Post a Comment